Immigration Insights

Great employees are the core of a successful business. Finding and recruiting the most talented workforce is vital for staying competitive. The global economy and the ability to connect and work remotely means that it’s easier to access a larger talent pool.

While recruiting talented people worldwide has simplified, the hiring process for employers is increasingly complex and may require outside expertise. Let’s explore the benefits and challenges of this complicated but rewarding process and what it means for employers.

Benefits of Building an International Workforce

Building a multinational workforce provides employers with numerous benefits, including the following:

- Access to the global talent pool. Employers know it’s advantageous to hire foreign workers instead of being limited to only domestic candidates, including those with specialized skills and knowledge that are locally scarce.

- Cultural diversity and perspectives. Diverse backgrounds foster innovation, different ways of thinking, and a greater understanding of global markets and customers.

- Language skills. Native speakers provide a competitive advantage for global business and improved customer service for a multilingual customer base.

- Operational flexibility. With an international workforce, companies can more seamlessly expand business operations and open new facilities across borders.

- Knowledge-sharing. Exchanging ideas from different cultures and backgrounds leads to more significant opportunities for skills transfer between domestic and international staff.

- Increased productivity. Research shows that diverse teams outperform homogenous groups, and varying viewpoints lead to more thoughtful analysis.

Common Challenges in Hiring Foreign Talent

Of course, there are many challenges and barriers when hiring international employees to work in the U.S. Employers often struggle with the following:

- Immigration compliance. Understanding and navigating immigration compliance is challenging. Understanding complex work visa and immigration regulations, ensuring proper work authorization, and sponsoring visas like H-1B and L-1 can be difficult, costly, and time-consuming.

- Employment eligibility verification. Properly completing I-9 forms with valid documentation and establishing systems for re-verifying employment eligibility require more work and processes.

- Legal and regulatory compliance. Adhering to national and local labor laws, data privacy and intellectual property protection considerations, and other regulatory issues adds stress.

- Logistical support. Considerations of visa application processes and lead times, relocation services like housing and transportation, and ongoing compliance monitoring and audits mean more layers of difficulty than with domestic employees.

Investing in training, seeking professional legal guidance, and developing robust compliance programs can help employers overcome these hurdles.

Guide to Hiring International Employees

Several United States government agencies are involved in hiring international employees.

Obtaining Proper Work Visas

Obtaining the proper work visa means determining which visa is compatible with your potential hire. An employer must assess job requirements, employee qualifications, and nationality to determine the correct visa.

Common nonimmigrant visas for temporary employees:

- H-1B registration for specialty occupations

- L-1 for intracompany transfers

Common immigrant visas are for those wishing to become lawful permanent residents:

- EB-1 for those with extraordinary ability, outstanding researchers, or certain multinational managers and executives

- EB-2 for professionals with advanced degrees and/or experience

- EB-3 for skilled workers, professionals, and unskilled workers

Additionally, employers must provide supporting evidence, such as job descriptions, employment contracts, employee credentials, labor condition applications, etc. Employers must also pay the required fees and follow processing timelines.

Confirming Employment Eligibility Verification

Employment eligibility verification is the process employers must follow to verify that their employees are legally authorized to work in the United States. The primary method is to complete the Employment Eligibility Verification Form I-9 for all new hires.

The I-9 form requires input from employers and employees, but the employer is ultimately responsible for reviewing, verifying, completing, and storing the I-9. Strict compliance by the employer is required, as employers can face severe penalties if they are negligent.

When to Consult an Immigration Lawyer

Employers can find it challenging to navigate the complexities of hiring foreign workers. With the ever-changing landscape of immigration laws,non-compliance risks are plentiful, and the consequences can be severe.

Don’t take chances with your international employees. Our dedicated team can provide strategic guidance and ensure your international hiring practices align with governing labor laws and regulations.

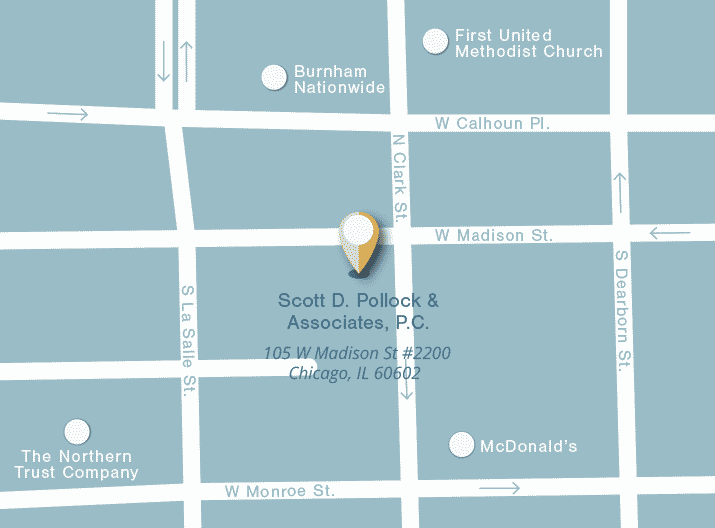

Protect your organization. Contact us today so we can help with your international employee hiring needs.

View Similar Articles