I-9 Audits and Compliance

What is an I-9?

Form I-9 is used to verify and identify the employment authorization of those employed in the United States. All U.S. employers must complete Form I-9 for each individual they hire. I-9 Forms must be signed by both the employer and the employee.

How I-9 Audits are Performed

The Department of Labor and Immigration and Customs Enforcement can perform an audit to ensure employers have the I-9 Forms and documents properly in order. Employers must be sure each employee has an I-9 Form in compliance.

Correcting Errors Found in an I-9 Audit

Errors may be discovered during an I-9 audit. Errors found in an audit may be corrected by the employer or the employee, but it is important that specific steps are followed:

- Draw line through incorrect information

- Enter correct information

- Initial and date correction or omitted information

Form I-9 F.A.Q.

Form I-9 should be completed by employers for each person on their payroll. Form I-9 should not be submitted to the USCIS, they should be stored by the employer. Forms should be available for audit and inspection if requested by the U.S. Department of Homeland Security, Department of Justice, or Department of Labor.

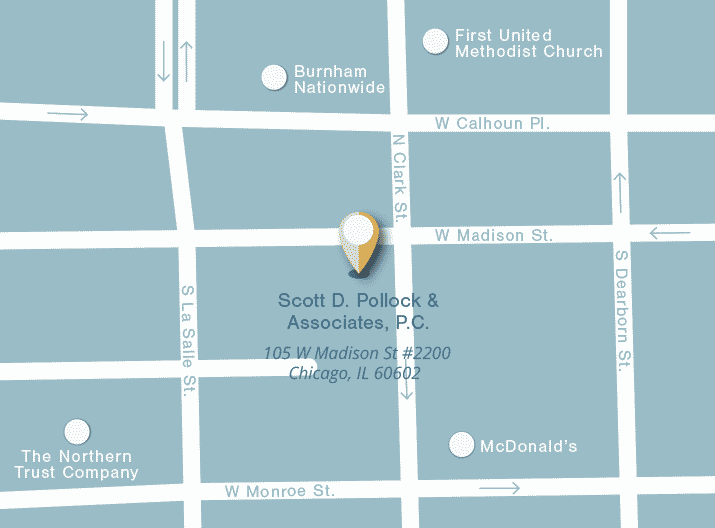

Contact an Immigration Lawyer Today

At Scott D. Pollock & Associates, P.C., we are experienced in I-9 compliance for employers. If you are an employer seeking legal assistance with I-9 Audits, contact our Chicago immigration attorneys today. Contact a member of our team at 312.444.1940.