Immigration Insights

Do you need to file United States taxes as an H4 visa holder? You might need an Individual Taxpayer Identification Number (ITIN) to do so. To apply for an ITIN, you will need to fill out an application, provide proof of identity and foreign status, and submit the application by mail or in person. The immigration attorneys at Scott D. Pollock & Associates can help you with this process. Call us at (312) 444-1940 to find out we can help.

This comprehensive guide outlines the process of applying for an ITIN, explaining what it is, why you might need it, and how to submit your application.

What Is an ITIN?

An Individual Taxpayer Identification Number is a tax processing number issued by the IRS to individuals who are not eligible for a Social Security number (SSN) but still need to file U.S. tax returns. This includes H4 visa holders and spouses of H-1B visa holders, who often find themselves needing to file taxes despite not being able to work in the U.S.

Your Step-by-Step Guide to Getting an ITIN

Ready to secure your ITIN and fulfill your tax responsibilities? Here’s a clear and concise overview of the application process, ensuring you have all the essential information and the latest updates.

Step 1: Gather Your Driver’s License, Passport, and Other Documents

- Form W-7, Application for IRS Individual Taxpayer Identification Number: Download and complete Form W-7 accurately, ensuring all information matches your passport or other primary identification document.

- Proof of identity: Submit a valid passport or other government-issued ID with a photo and your date of birth. Additional documents like a driver’s license or national ID card may work in some cases.

- Foreign status documentation: Provide proof that you’re not eligible for an SSN. A copy of your H4 visa, foreign passport with entry stamp, or I-94 arrival/departure record are standard options.

- Supporting documents (optional): Your situation may require additional documents like bank statements, tax forms, or rental agreements. Refer to the IRS website for detailed guidance.

Step 2: Choose Your Filing Method

- Mail: Send your completed application package with all required documents to the designated IRS address mentioned on Form W-7.

- IRS Taxpayer Assistance Center (TAC): Schedule an appointment and submit your application in person at a local TAC.

- Authorized Certifying Acceptance Agent (CAA): Find a CAA authorized by the IRS to accept and process your application for a fee. This option can be faster but incurs additional costs.

Step 3: Track Your Application

Allow six to eight weeks for processing by mail or seven to 10 business days for CAA submissions. You’ll receive a notification by mail once your ITIN gets assigned. This notification will include your ITIN number and instructions on how to access it online.

Key things to remember:

- Accuracy is crucial: Double-check all information on your application and supporting documents before submitting. Errors can delay processing.

- Stay updated: Check the IRS website for any changes in application procedures or required documentation.

- Seek professional help: If you’re unsure about specific details or eligibility, consider consulting a tax professional for personalized guidance.

Do You Need an ITIN as an H4 Visa Holder?

While not all H4 visa holders need an ITIN, there are several situations where it becomes necessary:

- Filing a U.S. tax return: If you have any U.S.-source income, such as interest from bank accounts or income from rental property you own in the U.S., you’ll need to file a tax return and will require an ITIN.

- Claiming tax credits: If you’re eligible for tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit, you’ll need an ITIN to claim them.

- Being claimed as a dependent on someone else’s tax return: If your spouse or another U.S. taxpayer needs to claim you as a dependent on their tax return, you’ll need an ITIN.

Understanding ITINs: Your Guide to Filing U.S. Taxes as an H4 Visa Holder

As an H4 visa holder, navigating the American tax system can be confusing. One crucial element you might encounter is the Individual Taxpayer Identification Number.

Think of an ITIN as a special tax ID number. Unlike a Social Security Number, it’s issued by the IRS to individuals who cannot get an SSN but still need to file U.S. tax returns. This includes H4 visa holders, who, despite not having work authorization, might have U.S.-source income or qualify for tax benefits.

Essentially, an ITIN allows you to meet your tax obligations and claim potential tax credits even without an SSN. It enables you to:

- File a US tax return: If you have any income from U.S. sources, like bank interest or rental property, you need to file taxes, and an ITIN makes it possible.

- Claim tax credits: Whether it’s the Earned Income Tax Credit (EITC) or Child Tax Credit, claiming these benefits often requires an ITIN.

- Be claimed as a dependent: If your spouse or another U.S. taxpayer needs to claim you as a dependent on their return, an ITIN ensures correct filing.

Why ITINs Matter for H4 Visa Holders

While ITINs hold importance for various individuals, understanding their specific relevance and application process for H4 visa holders is crucial.

These are the key considerations for H4 visa holders:

- Limited work authorization: As an H4 visa holder, you’re generally not authorized to work in the U.S. However, this doesn’t exempt you from tax obligations if you have U.S.-source income or qualify for tax benefits.

- Tax filing requirements: You might encounter situations where filing a U.S. tax return becomes necessary, such as:

- Receiving interest or dividends from U.S. bank accounts

- Owning rental property in the U.S.

- Being eligible for tax credits like EITC or the Child Tax Credit

- Claiming yourself as a dependent on another taxpayer’s return

- ITIN as the solution: Without an SSN, filing taxes or claiming these benefits wouldn’t be possible.

Benefits of Obtaining an ITIN as an H4 Visa Holder

There are many benefits to getting an ITIN if you are a H4 visa holder:

- Compliance and peace of mind: Filing taxes correctly becomes possible, ensuring you avoid potential penalties and remain in good standing with the IRS.

- Claiming tax credits: Accessing valuable tax credits like EITC or the Child Tax Credit can significantly reduce your tax burden and help support your family financially.

- Financial independence: If you receive income from U.S. sources, like rental property or investments, an ITIN allows you to manage your finances and file taxes independently.

- Future opportunities: Having an ITIN on file demonstrates responsible financial behavior and can be beneficial for future visa applications or potential changes in your work authorization.

An ITIN doesn’t grant work authorization. However, it empowers you to navigate the U.S. tax system efficiently, claim your rightful benefits, and pay taxes while residing in the United States.

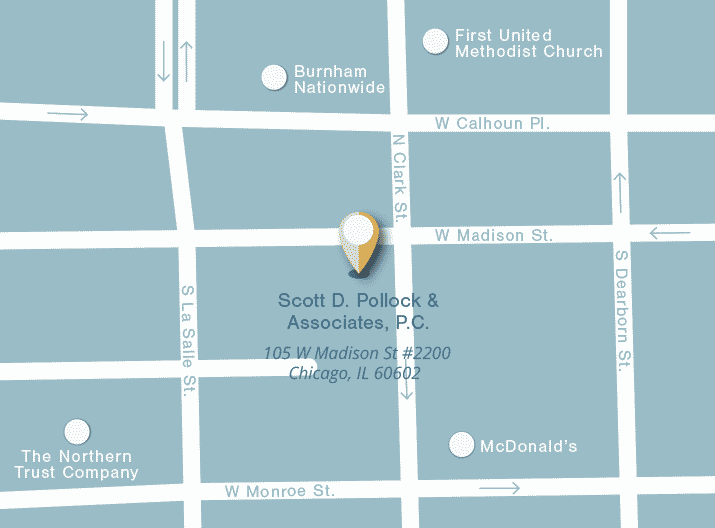

Scott D. Pollock & Associates, P.C. Can Help You Navigate the ITIN Application Process

Whether you’re an H1B, H4, or any other non-citizen visa holder, obtaining an ITIN is an important step to take when living and working in the U.S. The experienced Chicago immigration attorneys at Scott D. Pollock & Associates, P.C. are well-versed in the requirements for applying for an ITIN and can help you navigate the application process.

We can guide you through the documents you need to submit and ensure that your application is filed correctly with the IRS so you can reduce the chances of facing any delays or rejections.

Contact us today to learn more about how we can help you get an ITIN.

View Similar Articles