Immigration Insights

Since March 2019, employers across the U.S. have received over a half-million “no-match” letters from the Social Security Administration (SSA), informing them that the name or number listed on a W-2 wage form does not match SSA’s records. Since incorrect information may be due to any of a number of errors, employers must be careful to not assume that a no-match letter means the employee lied about their immigration status on an I-9 form. To avoid possible liability for unfair immigration related labor practices, the Justice Department’s Office of Special Counsel provides guidance on how an employer should respond to a no-match letter:

DO:

- Recognize that name/SSN no-matches can result because of simple administrative errors.

- Check the reported no-match information against your personnel records.

- Inform the employee of the no-match notice.

- Ask the employee to confirm his/her name/SSN reflected in your personnel records.

- Advise the employee to contact the SSA to correct and/or update his or her SSA records.

- Give the employee a reasonable period of time to address a reported no-match with the local SSA office.

- Follow the same procedures for all employees regardless of citizenship status or national origin.

- Periodically meet with or otherwise contact the employee to learn and document the status of the employee’s efforts to address and resolve the no-match.

- Review any document the employee chooses to offer showing resolution of the no-match.

- Submit any employer or employee corrections to the SSA.

DON’T:

- Assume the no-match conveys information regarding the employee’s immigration status or actual work authority.

- Use the receipt of a no-match notice alone as a basis to terminate, suspend or take other adverse action against the employee.

- Attempt to immediately re-verify the employee’s employment eligibility by requesting the completion of a new Form I-9 based solely on the no-match notice.

- Follow different procedures for different classes of employees based on national origin or citizenship status.

- Require the employee to produce specific I-9 documents to address the no-match.

- Require the employee to provide a written report of SSA verification (as it may not always be obtainable).

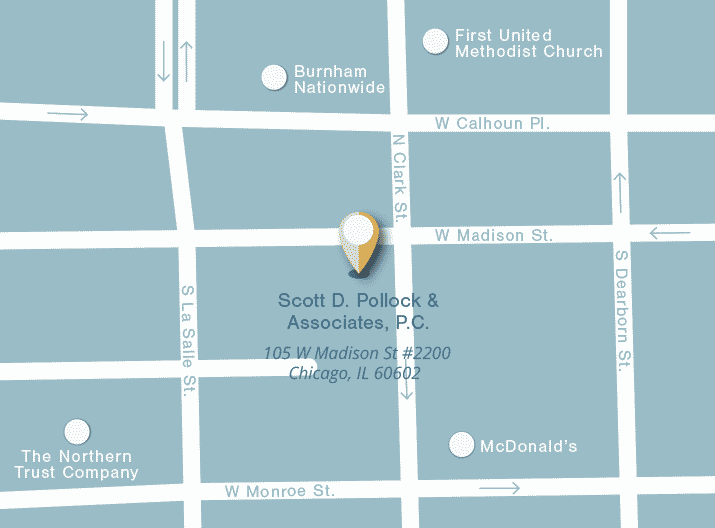

If an employer has any questions about an SSA no-match letter or immigration related issues, the Illinois immigration attorneys at Scott D. Pollock & Associates, P.C. are available for consultation or representation.

For more information on this or other immigration matters, please contact our office at (312) 444-1940 or consult@lawfirm1.com to schedule a consultation.

View Similar Articles